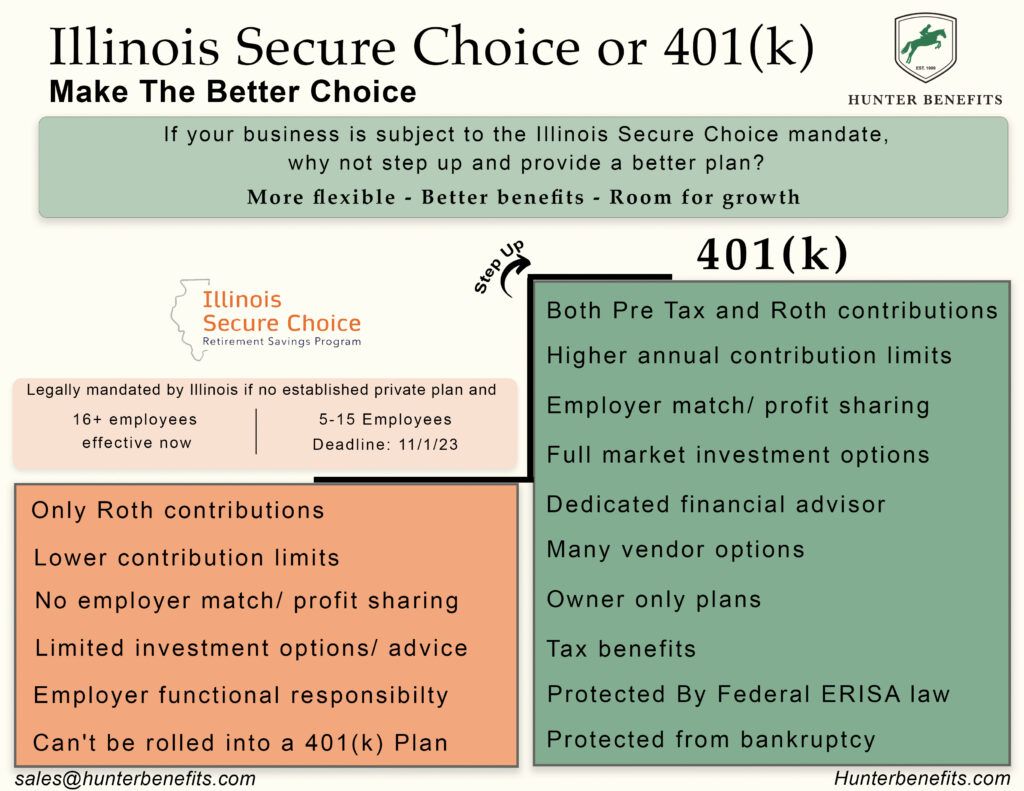

If your business is mandated to start Illinois Secure Choice, you may want to consider other options. Better options. 401(k) plans provide more benefits, more flexibility, and significant tax benefits.

Why Choose a 401(k)

ISC Features

- Smaller Contribution Limits

- Only Roth Contributions

- Limited Investment Options

- Little Help Managing The Plan

401(k) Features

- Larger Contribution Limits

- Roth and Pre-tax Contributions

- Full-market Investment Options

- Dedicated Financial Advisor

Check Out Our YouTube Video To Learn More

Save Thousands When Starting a New 401(k) Plan This Year

Starting a new plan this year can save you thousands in tax credits due to SECURE 2.0.

We have a Tax Credit Calculator to show you exactly how much you can save!

Start A 401(k) Plan Today

Start a conversation today. It’s easy and we’ll walk you through every step.

Learn More About 401(k) Plans vs Illinois Secure Choice

We have a blog post to help you make a better choice