The goal of this article is to help you (the plan sponsor) understand how cash balance plans work. Cash Balance plans (CB) can be overwhelming and they don’t work for everyone. There are lots of requirements and actions to be taken, but if the CB plan is right for you it can provide significant benefits.

A Cash Balance Plan is a defined benefit retirement plan which allows people to contribute significantly more money for their retirement. This allows preferred employees to get ready for retirement faster as well as save lots of money in taxes.

Cash Balance Plan In Depth

You know that CB plans are a type of defined benefit plan, but what is a defined benefit plan? According to the IRS, a defined benefit plan is “a fixed, pre-established benefit for employees at retirement”. Since you are defining a benefit for the future you are able to contribute more which also means you can deduct more at the end of the year. Meaning you save more in taxes. Although, it’s a bigger commitment and requires a stable business.

On the flip side, the one other type of plan you can have is a defined contribution plan. A 401(k) is a defined contribution plan. In this plan, the employer has a specified amount to contribute to the employee’s retirement plan. So the contribution amount is capped for each employee, limiting them on how much they can put away for retirement each year.

So if you want to get ready for retirement in the next 10 years, in a 401(k) (defined contribution) plan you’re only able to put away $225,000 ($22,500 a year). This is where the CB (defined benefit) plan shines. Because you have the ability to put away much, much more money in the same 10-year period.

The amount of money you are able to put away each year depends on many different factors and calculations. Factors like age, years of service, and compensation all affect how much money you can contribute.

Cash balance 401(k) Combination – Defined Benefit Disclaimer

Who Is A Cash Balance Plan For?

CB plans require a lot of money to maintain, so a business with a positive and consistent cash flow would be the best fit. If you don’t think you can maintain a positive cash flow or stable business for 3 – 5 years then a CB plan might not be the best fit for you.

Because CB plans require a commitment – since you are defining a benefit in the future – you need to be responsible and aware of this large commitment. If you are self-aware and know that you’re commitment adverse, a CB plan might be a risky option for you.

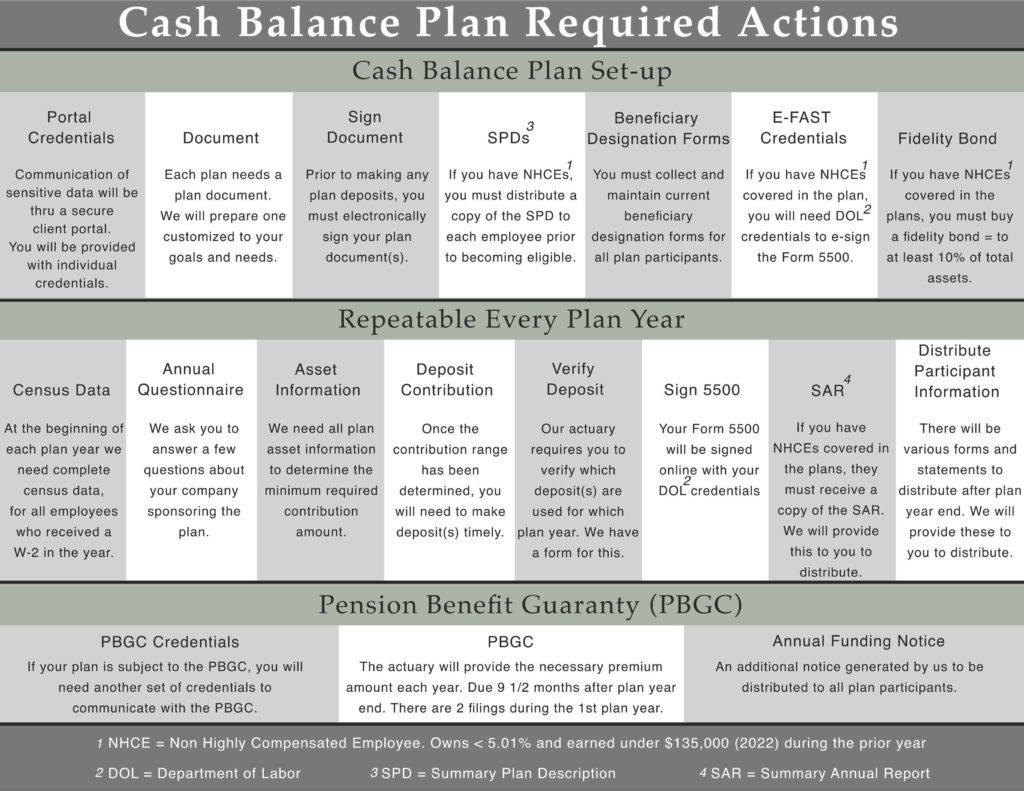

As an example, here are the required actions you need to perform to set up a CB plan as well as the annual required actions you need to perform.

Pros And Cons Of A Cash Balance Plan

Pros

- Larger contribution limits

- Shorter time to save for retirement

- Attract employees

- Keep employees longer

- Tax deduction (if managed right)

Cons

- Inflexible when started

- Ongoing commitment

- Employer assumes all investment risk