Hunter Benefits’ default employer non-elective (profit sharing) allocation formula has made an alternative option available to employers for a number of years.

How to benefit from this option now:

- Determine which of your staff is paying student loans

- Decide how much of those loans you want to count towards a match calculation

- Inform your consultant which employees are to receive the additional amounts

- Hunter Benefits will complete the necessary calculations (you may simply provide your consultant with the specific contribution dollar amount if you prefer)

- Please note the contributions:

- For this option are subject to testing as well.

- Are to be deposited in the profit sharing source, not the match.

- And, yes, these additional contribution amounts are subject to the same vesting rules.

You most likely don’t need to make any changes to your plan document to benefit from this flexible option. Instead of waiting until 2024 to help benefit your employees, you can make use of it for the 2023 plan year end. If your 2022 plan year end work is not yet complete, and you have not yet filed your taxes, you can make use of this for 2022 as well. (If you’re not currently a Hunter Benefits client, contact us to see how we can make this work for your plan.)

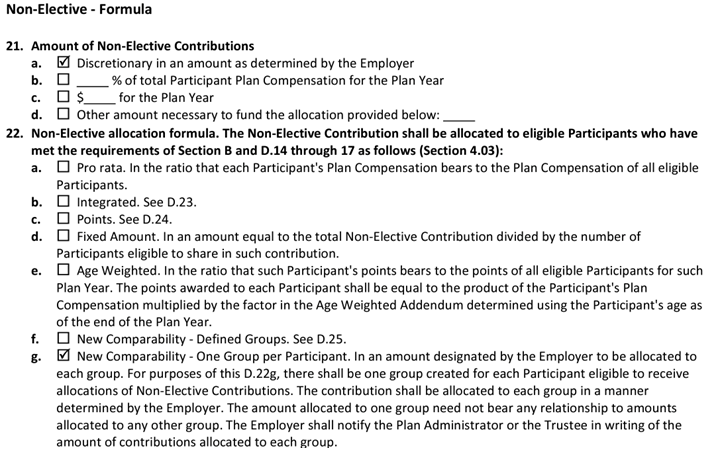

To determine if this option is available in your current adoption agreement today, go to Section D. Contributions, option 22g – New Comparability. An example is shown below:

Learn More About Secure 2.0

*The information provided is for general information only and not specific legal or tax advice. The information is not intended to, nor shall it be deemed to, constitute or provide legal or tax advice or counsel. Please consult with your tax professional to determine your specific tax situation.