Client Annual Checklist

This page shows everything you may need during the plan year to maintain a healthy plan. Each item has a brief description, an explanation of why you need it, and an action item of what you need to do.

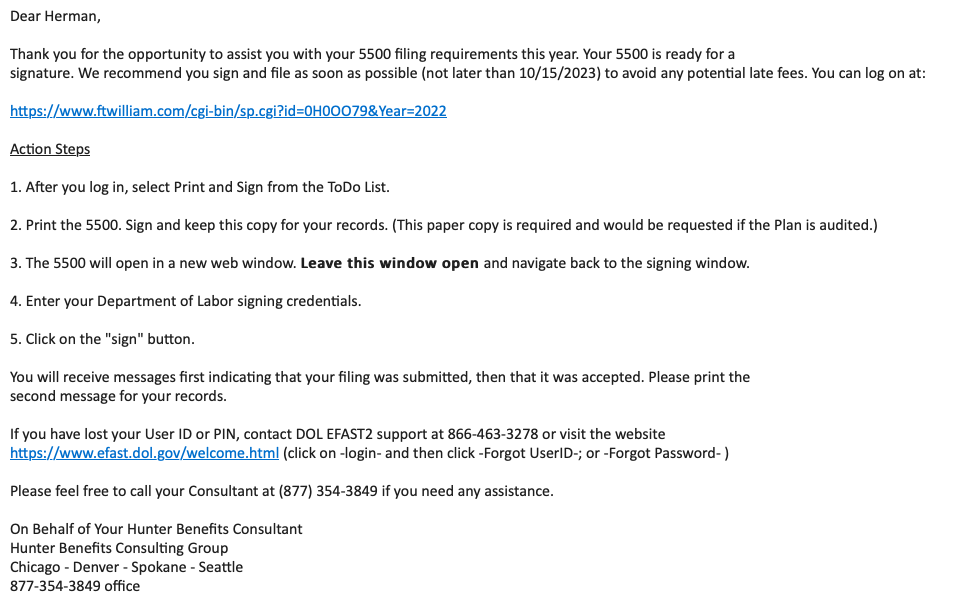

Hunter Benefits Consulting Group

This page shows everything you may need during the plan year to maintain a healthy plan. Each item has a brief description, an explanation of why you need it, and an action item of what you need to do.